Ever since its inception and throughout its turbulent journey toward mainstream acceptance, crypto has elicited both enthusiasm and trepidation in equal measure. After the unfair battering it has received over the years, the time has come to defend digital currencies.

Unfortunately for crypto, first impressions count. Bitcoin (BTC) initially gained a tawdry reputation in its early years as the currency of choice for illicit activities — favored by dark web users, ransomware hackers, drug traffickers and money launderers worldwide.

But, the world has changed since the first Bitcoin was mined in January 2009. There are now more than 18 million of them in circulation, and more than 90,000 people have $1 million or more stashed away in Bitcoin, according to cryptocurrency data-tracking firm Bitinfocharts.

There are, indeed, signs that crypto is, at last, gaining mainstream acceptance. Just last year, El Salvador declared Bitcoin as a legal tender in September and in October, the first Bitcoin futures-linked exchange-traded fund (ETF) in the United States began trading on the New York Stock Exchange. Payments giant Visa also launched a Global Crypto Advisory Practice in December, helping financial institutions advance their own crypto journey.

There are even talks of crypto becoming a medium of exchange in Afghanistan, offering a very real example of crypto enabling financial transactions in a situation where the monetary system itself is breaking down.

Related: How are Afghans using crypto under the Taliban government?

The obstacles and barriers

Despite these success stories, nagging doubts persist among the public and objections have been expressed by politicians who fear a decentralized currency that puts the general public in charge of their own money. China declared crypto transactions illegal in September, citing concerns about gambling and money laundering. Politicians around the world have expressed alarm about its potential to transform the established dynamics of the existing financial ecosystem.

The underlying factor behind all of this is fear and recent research suggests it could be a fear of the unknown. According to a national survey commissioned by money app Ziglu, almost a third (31%) of British people surveyed are curious about investing in crypto, yet 62% of those included have held back from buying any because they do not understand the market. As a sign that cryptocurrency is gaining legitimacy in the eyes of the public, however, the survey also found that b

Bitcoin is now considered a smarter investment than property.

Now is the time to recognize that while there are inherent risks, cryptocurrency is also a force for good in the world. In an age of plummeting savings rates, this relatively new asset class offers all of us the opportunity to invest in crypto without traditional barriers that exist in traditional finance, no matter how much or how little money we have available.

Related: Stablecoin adoption and the future of financial inclusion

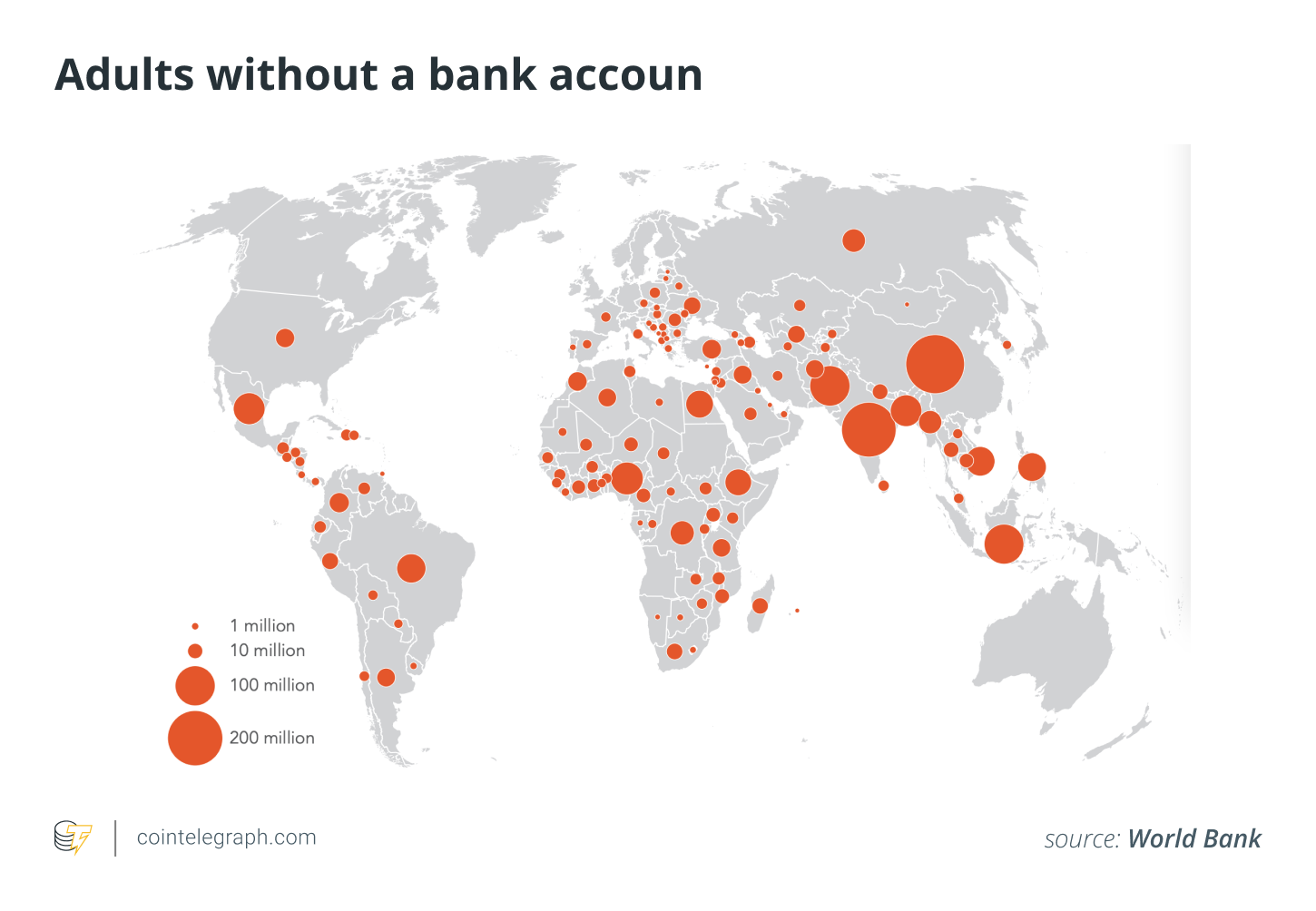

Some people do not even have a safe place to store their hard-earned cash. According to World Bank data, 1.7 billion people globally do not have a bank account. Many of us take for granted the ability to move money around through credit cards and bank transfers — sending large sums to our friends and family with a tap of our smartphones — but for the unbanked, this is not possible.

More than 80% of the world’s population do, however, own a smartphone, which is all they need to send crypto remittances across international borders. Crypto is boosting financial inclusion by giving millions of people with no access to platforms such as PayPal or Venmo the ability to transfer funds for mere pennies. It is also a good alternative for those who resent high bank fees since this new infrastructure, unlike the traditional payment rails, is not constrained by profit motivation.

Crypto’s advantages

Smart contracts can replace services from banks, money transfer companies or legal services, while cryptocurrencies and digital wallets can provide flexibility such as credit for customers and financial sovereignty with no centralized entity required.

Crypto can also shield citizens from economic turmoil. Venezuela is a prime example where many citizens are already suffering high inflation and the impact of United States sanctions that also affect their banks. They are increasingly converting their wages into crypto and using the blockchain for money transfers and payments.

For developing countries, Bitcoin is an excellent way for society to eliminate corruption because the community can track any Bitcoin transaction in the public ledger when people use the cryptocurrency to transfer money.

Closer to home, crypto is also democratizing finance. There are low barriers to entry with no need for a broker or a high net worth. Anyone can invest and create wealth for themselves. As a result, people are learning about concepts such as annual percentage rates, lending and borrowing, and the history and purpose of money.

Crypto’s disadvantages

But, any defense of crypto cannot avoid the elephant in the room: crime. It has long been associated with fraud and ransomware, but the truth is that blockchain is the perfect system to thwart such criminal activity.

Related: Bitcoin can’t be viewed as an untraceable ‘crime coin’ anymore

Cryptocurrencies are not anonymous, they are pseudonymous. The open ledger on which crypto lives and moves allows law enforcement to track and trace the flow of funds in real time, providing unprecedented visibility on financial flows. Criminals also need to convert crypto into fiat currency, creating opportunities to not only blacklist the wallet addresses but also proactively catch the criminals.

That is why, as in the Colonial Pipeline ransomware attack in the U.S.in June 2021, law enforcement was able to track and ultimately seize the ransom payment. That recovery was possible only because cryptocurrency was the medium of payment.

Related: Don’t blame crypto for ransomware

The advantage blockchain has is that it’s tamper-proof. Through a process known as consensus, each transaction is verified by multiple parties independently. Entries are immutable, meaning they can’t be modified and can only be updated by adding an addendum.

We are advocating for a specialist unit within cybercrime law enforcement. Why is it needed? To have dedicated technical and human resources that can work proactively with corporations that have been breached with a ransom requested in crypto. It would be able to communicate and notify all crypto exchanges so that they can identify when and if the criminal wants to cash out on the exchange.

Another issue rightly raised about crypto is the environmental impact: The enormous amount of electricity required to mine proof-of-work currencies such as Bitcoin requires warehouses full of powerful computing rigs constantly running.

However, this is already changing. Right now, more than half of Bitcoin miners use sustainable energy. A Bitcoin mining operation opened northeast of Niagara Falls on the site of the last working coal plant in the state of New York, using cheap hydroelectric power to run its rigs. Meanwhile, El Salvador’s President Nayib Bukele has announced an even more creative plan to use geothermal energy from the Conchagua volcano to power its Bitcoin City project.

Cryptocurrency’s journey to mainstream acceptance is almost complete. Therefore, now is the time to overcome our often unfounded fears and to embrace the financial freedom, security and convenience it offers.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Ian Taylor is the executive director of CryptoUK, an independent industry body that exists as a cohesive, credible voice for the evolving United Kingdom crypto industry. Having spent 20 years in investment banking, he has held many senior roles across trading, treasury and risk management, and is still involved with a major global bank. As executive director of CryptoUK, he has built a community of more than 100 of the most influential industry participants and campaigns for a fit-for-purpose regulatory framework in the U.K., Europe and beyond.